Fintechzoom best credit card: In the modern world, choosing the accurate credit card becomes an essential financial strategy as personal finance constantly transforms. Are you the one who is looking for a credit card on FintechZoom? Well if that is the case then you have come to the right place. With several options that provide distinct benefits, choosing a card that helps you with spending and financial objectives is significant. One such platform that emerges is Fintechzoom which is a prominent financial platform. The credit card provided by the platform presents a complete list of leading credit cards. These cards offer extraordinary cashback and rewards, competitive interest rates, and added financial benefits. Whether you want to optimise savings on your daily expenses or looking for a dependable financial tool, then this Fintechzoom selection is an invaluable asset.

Read on to learn the top credit cards that can benefit you make the maximum of your financial transactions. Let’s begin this blog ahead and continue reading.

What is Fintechzoom Best Credit Card?

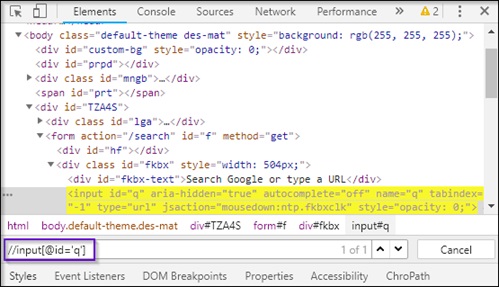

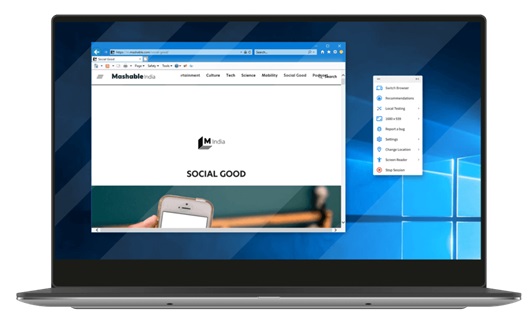

Fintechzoom best credit cards exemplify a groundbreaking financial management method in the ever-evolving world. Further, these credit cards are designed to streamline economic transactions, supplying customers with access to finances and revolutionary operations that improve the normal banking experience. In order to get started with fintech Zoom credit cards, the application process is quite simple due to the user-friendly interface. moreover, users can find the option online, comparing future, rewards, and expenses to discover the best credit card that fits their financial needs and lifestyle. What sets this credit card different from others, the fintechzoom credit card entirely operates online, with no physical branch location. User can track their spending, make payments and manage accounts from the convenience of a smartphone or computer.

Features and Benefits of Fintechzoom Best Credit Card

Cashback and Rewards

Card hotels can enjoy various benefits from absolute cashback on routine purchases with additional reports for dining, travel, and shopping. Further, these benefits aim to enrich the financial experience by making expenses more rewarding.

Low interest rates

The platform delivers options with reduced APR for cardholders who maintain balances, lowering borrowing costs, and simplifying credit management.

Travel benefits

Regular travellers are eligible for various benefits that enhance the trip experience and result in significant savings, for instance, travel insurance, airport lounge access, and no office foreign transaction.

What are the Criteria for Selecting the Best Credit Cards?

Annual percentage rate

The interest you will pay on your outstanding balance is crucial if you plan on carrying a balance.

Annual fees

The cost of keeping the card would significantly affect the value of the rewards and paybacks it offers.

Introductory offers

Several cards come with signup bonuses, 0% APR periods, cashback deals, and many more, which can be pleasing and appealing.

Regular rewards

Cardholders can earn rewards through points, miles, or cashback on purchases.

Redemption flexibility

The handedness and variety can provide cardholder rewards that can affect their value.

Secondary benefit

This benefit contains such as insurance, travel, and purchase protection, and even access to airport lounges. Essentially, it can announce the credit card value proposal.

Fintechzoom Best Credit Cards

SoFi credit cards

This card is for beginners with a straightforward approach and beneficial features. This card contains competitive interest rates, perks, and minimal fees. The perks include cell phone protection and office on international transactions.

M1 owner’s Reward card

This card would be perfect for investors. it combines credit use with investment accounts and enables pending rewards to be directed invested.

Self-secured visa

This card has become a top choice for establishing credit. Further, it needs a deposit that sets the credit limit and reduces the risk while consistently enhancing credit status through major credit bureaus.

Secured chime credit builder visa card

It eliminates the need for a credit check. It supports building a great profile without the usual fees.

Petal 2 Visa credit cards

It targets those who have little or no credit history. it evaluates creditworthiness using alternative data and offers higher limits, than other beginner cards along with frequent rewards and cashback.

Update cash rewards visa

This card combines traditional credit card, benefits with personal loan features. in addition, it provides tax payment rates and cashback rewards.

Cred.Ai Unicon card

This card is made specifically for tech-oriented users. This card is introduced with features like spending predictions and automated great improvement at no cost.

Using Bonus Offers and Promotions

In order to get the benefit, from credit card usage then Fintechzoom frequently run bonuses and promotions. These include signup bonuses, limited time, promotions, and spending bonuses. Users have to keep an eye on their credit card company website or promotional email to ensure the fine print before signing up. By following these steps, you can maximise the rewards delivered by Fintechzoom credit cards and. keep in mind that it is important to use a credit card responsibly and pay your balance in each one to avoid interest charges.

How to Choose the Right FintechZoom Credit Card for Your Requirements?

Do consider the reward program for credit cards such as the annual and reward earning application. Make sure that the reward is aligned with your purchases and provides most of the benefit for your spending.

Make sure that you should review the interest rate and face for credit cards that you are considering such as APR, balance, transfer fees, foreign transaction fees, and late payment fees. Certainly, these fees and rates would prominently impact your card’s overall value. Make sure that your credit card provides additional features that should be aligned to your lifestyle such as travel, insurance, purchase, protection, and other services.

Final words

Fintechzoom offers you travel credit card choices to shape credit maturely while earning the maximum rewards. Remember to pick a card that aligns with your expenditure ways and financial goals. This is the closure of this blog. Toddles!