DA For Central Government Employees: Dearness Allowance is a cost of living alteration that the government pays to public sector employees and pensioners. For this reason, India has been analysed with many actions to limit the effects of increasing inflation in the country. One of the main measures that hit the most is Food commodities, which often have a direct impact on the economy. Therefore, the government of India has introduced a Dearness Allowance to protect the everyday lives of citizens. Are you keen to know what does it just involve? How is DA calculated? Or how does it affect the salaries and pension of government employees? Come along by reading this blog till the end to get to better understanding of this allowance. Let’s start this blog ahead and continue reading.

What is Dearness Allowance?

Dearness allowance is a calculation of inflations and allowances that are paid to public sector employees, private sector employees and civil servant pensioners in India. Further, to help them to cope with the increasing prices. Despite taking these measures, it helps to control the inflations. Furthermore, it is calculated as a percentage of an employee’s basic salary to moderate the impact of inflation on people. Certainly, citizens may get a basic wage or pension that is added by housing or a dearness allowance. However, the guidelines provided by the government may vary according to where one lives. Evidently, it means the DA is different for employees in the urban sector, semi-urban sector, and rural sector. After that, it is a fully taxable allowance.

Key points about DA For Central Government Employees

DA is usually revised two times in a year first in January and second in July.

The percentage of DA is calculated based on the CPI.

All central government employees are eligible for DA.

DA is considered as a proportion of the basic salary.

DA is fully taxable as income.

When Dearness Allowance was introduced?

This allowance was introduced after the Second World War. At that time, it was known as the “Dear Food Allowance.” Formerly, DA was provided in response to the demand of employees for wage amendment. Later, it was linked to a customer price index.

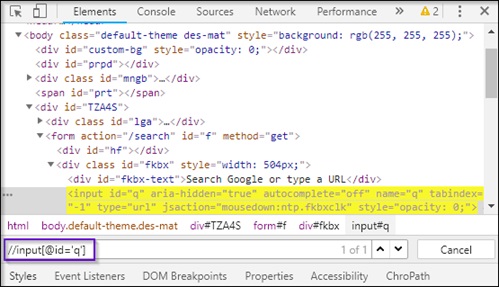

How to Calculate Dearness Allowance?

DA is offered to employees to protect against the rise in the price of a certain financial year. Plus, it is calculated twice every year, in January and July. Further, the formula to calculate the dearness allowance was amended in 2006 by the government. Currently, DA is calculated as per the formula that is given below.

For central employees

DA% = (Base Year 2001 = 100) for the last 12 months – 115.76)/115.76] x 100

For Public Sector Employees

DA% = (Base Year 2001 = 100) for the last 3 months – 126.33)/126.33] x 100

Let’s take a look at Income tax and Exemption limits

According to recent updates, DA is completely taxable for citizens who are salaried employees. However, in the case they employees who are provided with rent-free unfurnished accommodation, DA is part of the salary to some extent. After that, it is a part of the employee retirement benefits salary under the condition that other prerequisites are met.

How many Types of Dearness Allowance?

There are two types of allowances. Here is the list of it.

Industrial allowance

The government of India provides this allowance to the employees of public sector companies. Further, the government look over the rate of DA every quarter. However, it is completely based on the consumer index.

Variable allowance

The central government provides DA to employees who are employed under it. Further, the government look over on a half-yearly basis. Plus, it is based on the consumer price index.

Consumer price index

This index changes every month and plays a prominent role in the calculation of the variable dearness allowance.

DA amount set by the government

It remains the same until the government increases and decreases the basic minimum wage.

Base index

This index remains the same for a fixed time period.

Dearness Allowance vs House Rent Allowance

It is estimated as a particular percentage of the basic salary of an employee. After that, it is added to the basic salary with various other factors for example house rent allowance. Plus, it makes up the overall salary of a government sector employee. Furthermore, HRA is a salary component offered to an employee by their employer to meet the expenses of accommodation. Indeed, it is applied to both public and private sector employees. On the other hand, DA mainly applies to government employees or employees working in the public sector.

Pay Commission

Pay commission estimates and changes the salaries of public sector employees according to the several modules of the final salary of an employee. After that, DA is measured by the pay commissions when preparing the following pay commission reports as well. However, the influence of the calculation of salaries assigned with the pay commission.

Final Words

The objective of offering DA is to ensure that keeps the same with the rising cost of living and aids in maintaining the purchasing power. However, especially, in the between of inflammatory power. This fetches us to the finish of this blog. Toddles!