MetaTrader 4 (MT4) stands as a titan in the world of Forex trading, renowned for its flexibility, powerful analytical tools, and the ability to cater to traders of various levels. One of MT4’s most dynamic features is the Market Watch window, a powerful hub of real-time price data and financial instrument details. Perfect customization of the Market Watch window can greatly enhance your trading strategy and market analysis efficiency. This detailed guide is designed to walk you through optimizing this feature to suit your trading needs, ensuring a blend of technical prowess and user-friendly operations with metatrader 4 windows.

Understanding the Market Watch Window

The biggest novelty of the Market Watch window is not just a list of trade prices: it also shows the latest news, contains any recent comments from traders, and lists upcoming significant economic events. The wordings such as currencies pairs, indicators, and securities makes it possible to get the financial market data at the exact time when it occurs. However, this should be kept in mind as this is an essential functionality that allows the trader to have good insight into the market and be up-to-date with the latest movements.

Customizing window of Market Watch has several benefits.

Several benefits come with customising the market watch window, such as time efficiency, narrowing down the cart to preferred instruments, and also simplifying decisions. Such a functionality harnesses the ability of the traders to fabricate a trading platform that is personalized as per the preferences of the strategies, risk, and individual taste of the traders.

Market Watch Window – A Way To Tap Into the Market

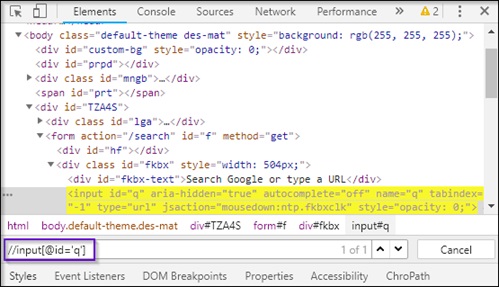

The Market Watch is one of the key windows in the Metatrader 4 and hence, getting access to it is a simple thing to do. As common, MT4 window should usually be located on the left side of the screen once you have started the application. If the toolbar is not displayed yet, respectively you can activate it by Open/View in the menu bar and selecting “Market watch” or simply write down Ctrl+M on your keyboard. The shown window lists resources for buying and selling that are available at the exchange in terms of bid and ask rates.

How to implement the custom Market Watch Window

- Playing, in and out of, Instruments

To make your trading environment the way you want it, you may perform some customizations, such as adding or removing a trading instrument from the Market Watch window. To add an instrument press Access to Market Watch window with right icon (click)than symbols and choose from a list of available instruments. There is nothing complicated about getting an instrument to your Watchlist, as in order to do it you just need to locate the symbol you are interested in and click “Show”.

At the same time, in place of the instrument is selected, right-click on the symbol, you want to delete and choose Hide from the drop-down menu. This way your trading process is optimized, because the instrument list you must choose from is reduced to the ones that correlate with your trading strategies.

- Making Apparatus of Mass

This tool will be helpful to traders who gain from monitoring multiple assets at the same time because it is it will give a boost to their monitoring effectiveness. Right-click inside the market watch window, select Sets, then “Save As” for a new set. This function is, in my opinion, the most appropriate for those traders who set their goals in particular markets and use various techniques in working across different asset classes.

- General function of an instrument including but not limited to its campaign details, classification, capabilities and development status.

A lot of times, when a person has a profound understanding about a device, it may be the precipitating element why a person makes trading choices. You can obtain these details by choosing “Specification” through the context menu, which is displayed when you right-click on the chosen instrument. This step provides you with the important information, like spread, contract size, and margin level which help evaluate every detail before starting trading.

- Using the Tick Chart

The windows named “Register FOR ” also have Tick Chart function which are responsible to show the real time price activities chart for the selected instruments. After clicking on the desired currency pair or instrument a user can get the visual feedback of short-term market dynamics by clicking on the tab. “Tick Chart”.

Best Practices for the Use of the Change Overview Window

Stay Organized

Stay abreast in the market by keeping Market Watch window screen clean and neat, and only putting the instruments that are under your current strategy into screens This, in turn, eliminates the chances of distractions and promotes attention on the analysis of core markets for enhanced effectiveness. Many people believe that college is the best time to figure out who they are and what they want in life. For me, this is a crucial time for personal growth and self-discovery. College is a place where I can explore different interests, learn about myself, and develop essential life skills. One

A practical method to keep the organization high in the market watch window is to include only trading instruments which are vital in your trading strategy or plan. This means easing off the fewer utilised or those that are selected less often instruments from the Market Watch list. Investors can reach a more organized interface that provides just the data that they are in need of in the course of their trading by clearing the window.

In order to keep a Market Watch window clean and arranged, traders have a ability to customize which instruments are displayed by the right-click option within the Market Watch window and select the ‘Symbols’ option. They can do this fluidly here, trading instruments on/off the list, re-arrange their order according to rank, and even go ahead to create custom watchlist.

Through incorporating just the tools that match the trading plan early on, traders can be saved from making an attempt to trade impetuously and work on unfamiliar markets without diversifying their skills. It enables them to main orderliness and coherence within them when they are dealing with the markets. This is an indispensable requirement for longevity in the market.

As such, efficient Market Watch window provision empowers investors with seamless trading aids for constantly monitoring major markets and detecting trading opportunities in the process. It would mean as the noise and every distraction are removed, and more focus is directed toward analyzing price movements, detecting trends, and basing trading decisions on sound data.

Language: Constantly Keep Your Instruments Updated

Actions and trading interests may vary as market conditions change too. Revision of instrument list is must, and it should be done periodically, as it ensures that the one looks up at Market Watch, sees the opportunities that can be the center of attention.

Use Labels for Separate Trading Sessions

Worldwide forex trading process, providing different platforms for different trading sessions, is the best way that forex traders use to exchange the common currency. g. The investments team maybe able to profit from the fact that central locations like London, New York and Tokyo are running at different times in the supplies schedule.

In the last note I would like to emphasize on the significance of keeping structured Market Watch Window for effective trading. The traders can reduce reactions to extraneous instrument spikes by including only those instruments in their trading plan that are directly relevant to their trading plan. This will, in turn, increase the level of market focus and make their trading plan streamlined and easily executable. As a result of this, traders can closely monitor their access to key markets and advance with their trading by practicing to stay disciplined and not letting their emotions take control. This will finally contribute to better trading outcomes.

Customized market overview of the MT4 software is a real world dimension of successful trading results, only if traders manage to utilize the window flexibilities to their benefits. By optimizing this feature to the preferences of your trading, you will support the growth of your analytical arsenal providing an opportunity for a closer access to a more focused, well-structured, and strategic trade. Recall the fact that the effective trading expediency is predicated not on what tools are used, but on how well they are adapted to match the trading style and tendencies desired.

The goal of this guide is to help you acquire knowledge and skills so that you can personalize the Market Watch windows of MetaTrader 4, thus to maximize your trading platform performance and achieve better performance. Happy trading!