Probably, the first thing that comes to mind when you think about Term Life Insurance is not “investment” or “profit.” Term Life Insurance is usually designed as a safety net for your family, providing financial support in case of an unexpected loss. However, a growing interest surrounds whether Term Life Insurance can serve as a financial tool to generate returns or reduce costs in innovative ways.

Let’s discuss whether it is possible to earn money with Term Life Insurance in Canada and what options and limitations apply.

Understanding Term Life Insurance as an Investment

What is Term Life Insurance?

Term Life Insurance is a straightforward insurance policy that provides coverage for a specified period or “term,” such as 10, 20, or 30 years. The insurer pays a death benefit to the beneficiaries if the insured person passes away during the term. It’s pretty well known for its affordability, as Term Life Insurance Rates are significantly lower compared to whole or universal life insurance policies.

Can Term Life Insurance Be Considered an Investment?

Unlike permanent life insurance policies, Term Life Insurance typically doesn’t build cash value over time. For this reason, it isn’t traditionally viewed as an investment. However, there are creative ways to approach Term Life Insurance as part of a broader financial strategy, which we’ll cover in detail below.

Lowering Costs Through Term Life Insurance Quotes Online

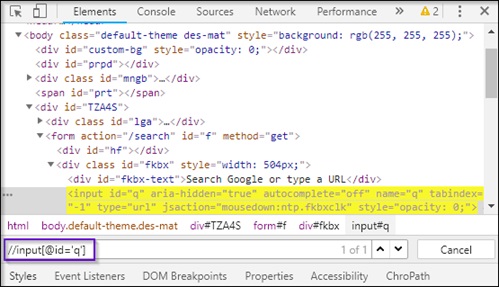

The first step to “saving” or making money with Term Life Insurance is choosing the most affordable option. In Canada, online platforms that can compare Term Life Insurance Quotes Online have made it easier than ever to find competitive rates.

How Comparing Quotes Helps Save Money

- Wide Range of Choices: You can view several policies of different insurers from one page.

- Tailored Coverage: You can set the amount and term of your coverage so that you are not overpaying for features you don’t need.

- Transparency in Pricing: Online quotes often break down the premium structure, helping you see where your money goes.

By choosing the right policy, you save money with the competitive Term Life Insurance Rates compared to overpaying for a similar policy somewhere else.

Leveraging Term Life Insurance as Collateral for Loans

In Canada, it is sometimes possible to use a Term Life Insurance policy as collateral for loans from some financial institutions. The option is more typical of permanent life insurance, but there are indeed certain scenarios in which a term policy may qualify.

How This Works

- The policy assigns a death benefit to the lender.

- In case the insured dies before repaying the loan, the death benefit is given to the lender, ensuring that the loan is paid off.

- This can, therefore, result in securing lower interest rates or better terms on a loan.

It does not make money directly, but it will lower the cost of borrowing and free up some funds for other investments.

Term Life Insurance Laddering Strategy

Laddering is when you purchase Multiple Term Life Insurance Policies with different periods and coverage amounts. Such a strategy ensures that one will have the right amount of coverage at the right time. In addition, premiums get lower over time.

How Laddering Works

- Purchase several term policies with staggered expiration dates.

- For example, you might buy a 10-year, 20-year, and 30-year policy simultaneously.

- As your financial obligations (like a mortgage or children’s education) decrease, the shorter-term policies expire, leaving only the longer-term ones.

Financial Benefits

- You avoid paying for unnecessary coverage as your financial needs evolve.

- The overall cost of coverage is optimized, helping you save money.

While not a direct “profit,” this strategy allows you to retain more of your income over time.

Return of Premium Riders

A return of premium (ROP) rider is an optional add-on to some Term Life Insurance Policies that refunds the premiums you’ve paid if you outlive the policy term.

Is It Profitable?

- You get back your premiums at the end of the term, so if you do not file a claim, Term Life Insurance can be considered a “no-cost” coverage.

- Of course, ROP riders incur additional premiums. Calculations must be made to determine if the increased premium is worth the refund.

Considerations

While ROP riders can seem attractive, the added costs may outweigh the refund, especially if you could invest the additional premium elsewhere for potentially higher returns.

Using Term Life Insurance to Offset Business Risks

Term Life Insurance reduces the financial risk for business owners, and an essential employee or owner is protected with the term life policy known as key person insurance.

Financial Benefits

- Protects the company’s revenue in case of the insured person’s unexpected passing.

- Provides funds to hire and train a replacement or cover debts.

In this case, the policy indirectly “makes money” by safeguarding the business’s financial health.

Utilizing Savings from Lower Premiums

Term Life Insurance has affordability as one of its primary benefits. Compared to Whole Life Insurance, Term Life Insurance is usually cheaper, so the policyholder may invest elsewhere.

How to Maximize Savings

- Put the saved premiums into growth-investing products such as stocks, mutual funds, or ETFs.

- Such investments can earn returns over the long term, thus making the Term Life Insurance part of a greater wealth-building strategy.

Example of Savings Potential

- A whole life insurance policy may cost $300/month, whereas a similar term policy might cost $50/month.

- Savings of the $250 monthly difference at an annual return of 5% over 20 years will sharply increase one’s wealth.

Selling a Convertible Term Life Insurance Policy

Some Term Life Insurance policies in Canada include an option to convert the policy into permanent coverage before the policy expires. Converted policies, in very rare cases, can acquire cash value that may be accessed or sold later.

Is This Profitable?

- The primary value lies in the flexibility to retain coverage and potentially access the cash value of the permanent policy.

- Selling the policy to a third party (in provinces where virtual settlements are allowed) might be an option, but this is more common in the U.S. than in Canada.

Life Settlements and Viatical Settlements

Life settlements, where a policyholder sells their insurance policy for a cash payout, are less common in Canada. However, it may be possible under specific circumstances and provincial regulations.

Key Points to Consider

- Policies sold through life settlements typically yield less than the death benefit but more than the surrender value (if applicable).

- This is a niche scenario and often not the most efficient way to “make money” with Term Life Insurance.

Leveraging Tax-Free Death Benefits

While it’s not a way of “making money,” this tax-free nature of payouts through Term Life Insurance can go a long way in saving the hard-earned income of your loved ones. Plan coverage accordingly so that your beneficiaries can enjoy the maximum benefits tax-free.

Limitations to Making Money with Term Life Insurance

It is important to remember that Term Life Insurance works primarily as a safety precaution rather than an investment opportunity. Here are a few downsides:

- No Cash Value: While permanent policies build up a cash value over time, Term Life Insurance does not.

- Coverage Expiration: Once the duration is over, the insurance automatically lapses without payout unless a claim is filed.

- Opportunity Cost: The premiums paid for Term Life Insurance can be invested elsewhere with greater returns.

Making an Informed Decision

Whether you’re exploring Term Life Insurance Investments, comparing Term Life Insurance Quotes Online, or looking for ways to save on premiums, it’s essential to approach the process with a clear understanding of your financial goals.

Key Takeaways

- Term Life Insurance isn’t traditionally a money-making tool, but strategic use can create savings or offset costs.

- Comparing Term Life Insurance Rates online is a simple and effective way to reduce costs.

- Additional strategies, such as laddering or adding the return of premium riders, can enhance the financial benefits of your policy.

Instead, Term Life Insurance becomes just part of an overall financial planning scheme that maximizes value while creating peace of mind for loved ones. With some limitations with direct profit-making, various creative approaches can be brought to help turn Term Life Insurance into a smart money play.